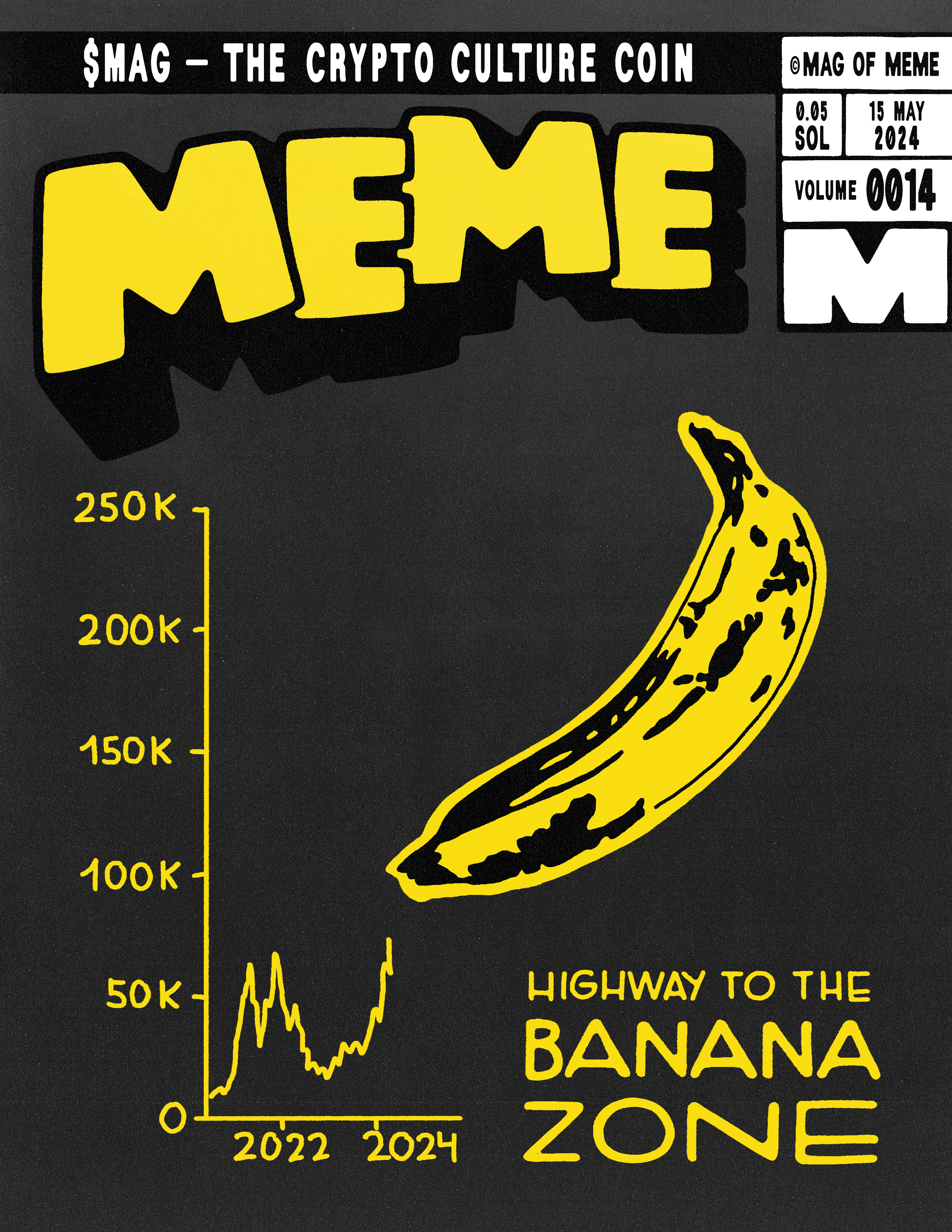

There's a new buzzword driving Crypto Twitter bananas this week — "Banana Zone." Macro guru Raoul Pal (@RaoulGMI) has introduced this latest addition to the crypto lexicon, promising it will help explain the cyclical nature of global liquidity and its impact on asset prices. Spoiler alert: it involves a lot of jargon and, yes, bananas.

Pal, in his quest to sound both cryptic and prophetic, has linked the "Banana Zone" to his "Everything Code" framework. This grand theory aims to decode the cyclical liquidity waves since 2008 and how they influence the macro seasons — think summer and fall, but for your crypto portfolio.

The theory goes like this: Since the 2008 financial crisis, the global economy has been riding a cyclical wave of liquidity, resetting interest rates to zero and extending debt maturities to 3-4 years. This cyclical pattern supposedly helps debase fiat currencies, making asset prices look like they're skyrocketing when, really, we're just devaluing money.

Pal's "Everything Code" suggests that every few years, as global liquidity rises, it prevents a debt apocalypse and sends growth assets like tech and crypto into a frenzy. According to Pal, crypto adoption is mirroring the internet boom, with potential market cap growth from $2.5 trillion to a jaw-dropping $100 trillion.

He has identified a sweet spot in this cycle, aptly dubbed the "Banana Zone," where growth assets (particularly crypto) outperform. During this magical period, Bitcoin and its memecoin brethren are expected to go bananas. Pal's followers are now feverishly tweeting about the Banana Zone, despite most having no clue what it actually means.

Let's be honest: the Banana Zone could be anything from a market sweet spot to a tropical smoothie recipe. But that hasn't stopped the crypto community from going ape over it. "Are we in the Banana Zone yet?" tweets one confused trader. "Bought more bananas just in case," another replies, showcasing the blend of literal and metaphorical bananas in play.

As we approach this mystical Banana Zone, Pal advises investors to keep a cool head. He suggests taking partial profits and warns against "mid-curving it" — a phrase that sounds both technical and vaguely insulting. Remember, in the Banana Zone, numbers are supposed to go up over time, even if the path is littered with peels and pitfalls.

The Banana Zone might be the latest craze to sweep through the crypto jungle, but whether it holds the secret to untold riches or just another fruity fad, remains to be seen. As we swing through this latest hype - remember apes: keep your diamond hands steady and your bananas close. After all, in the wild world of crypto, it's all about surviving the swing and landing in the green.